Brief Summary

This course dives into peer-to-peer lending, showing how it can help your business with short-term funding. You'll learn about the importance of credit scores and how to effectively use platforms like Prosper and Lending Club to increase your chances of getting funded.

Key Points

-

Peer-to-peer lending cuts out the middleman, saving on costs.

-

Credit scores and collateral are still important.

-

It's not for complete funding rounds, but can help in a pinch.

-

P2P lending is a cool way to boost short-term cash flow.

-

You’ll learn about platforms like Prosper and Lending Club.

Learning Outcomes

-

Understand the basics of peer-to-peer lending.

-

Identify strategies to increase cash flow temporarily.

-

Create an attractive profile on P2P lending sites.

-

Learn how to navigate platforms like Prosper and Lending Club.

-

Use P2P lending to connect with potential investors.

About This Course

Learn how peer-to-peer lending may be a source of short term funding to keep your business growing.

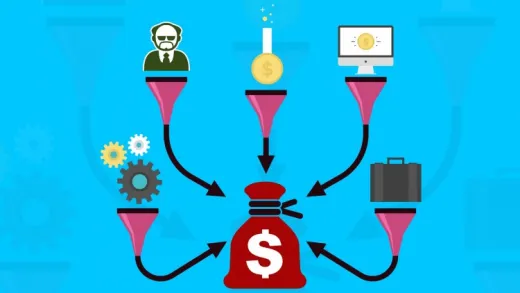

Peer-to-peer lending, also known as person-to-person lending, peer-to-peer investing and social lending, is a financial transaction that occurs directly between individuals without the assistance of a bank. What this model does is cut out the costs of a traditional intermediary, allowing you access to potentially cheaper loans. However, credit scores and other aspects of lending such as collateral are still important to the process.

While P2P lending might not be a source of funding to complete an entire capital round, it certainly might help complete one. It may also be a source of short term funding to keep your business growing if cash flow becomes a problem.

If you feel you need a bridge loan for a short period of time to cover operating costs, peer-to-peer lending could be utilized. Our course, "Bring Money in With P2P Lending" will give you an introduction to the way creative financing occurs. Think about how a P2P Lending site could be used strategically. Could this be a way for you to attract new followers, friends and fans? Sign up for the course today and learn from the INVESTyR DealTeam.

By the end of the course, you will be able to understand how P2P Lending can increase cash flow for your business with temporary loans

In this course, you will learn how to use sites like Prosper and Lending Club

Create a profile that will increase your odds of getting funded by others

Frankie

Media quality of the videos were poor, as if they didn't really invest in making these videos well or at least edit them.